NHL News

Matt Perri shares his Coyotes experience creating the Draft Pick Value Table

Matt Perri, former Director of Analytics for the Arizona Coyotes, shares his experience developing the Draft Pick Value table. This table is the basis for the PuckPedia Perri Pick Value Calculator, check it out!

Market Value

Part I: Draft Pick Value

I’m lucky. I had never worked for a pro team before I was hired to lead the Arizona Coyotes analytics department, let alone an NHL team. I was a fan of the game who ended up on the inside.

I spent the previous six years working at Sportlogiq, the main advanced data partner of almost every NHL team, working my way up from a data-entry position to running their hockey product. I had the opportunity to work with a lot of NHL execs, coaches and analysts in this capacity, providing them with data packages, reports and insights. It gave me an invaluable window into the way different teams go about using data. When I interviewed with the Coyotes, I told them that I believed I knew more about hockey analytics than anyone on the planet.

I say that not to brag (everyone in a position to run an NHL analytics department probably feels that way), but to emphasize how naive and unprepared I was for many of the ways that the NHL works.

What’s He Worth?” vs “What’s He Going to Go For?”

If you follow the NHL, you’ve seen people argue about what a player is worth. Whenever a player is signed or traded, fans and media inevitably debate if the price was right.

Before working for an NHL team, I spent a lot of time thinking about how teams assign value to assets but little time on how they actually assign value. Once on the inside, I quickly discovered that a significant amount of Hockey Ops staff’s time (even the analytics department) is spent establishing the market value for potential signings and trades. Every NHL team will make a few signings and trades per season, but they will research and explore many more ideas than the ones that are actually executed. All of these potential transactions require knowing the market value of the assets involved, because no matter what your scouts or analytics think of a player, the player will (almost certainly) be exchanged at market value

Precedent & Comps

Establishing market value in the NHL involves digging through historical precedent to establish comparables, usually referred to as comps. In player signings, for example, comps are historical contracts with similar terms to the target player’s situation. Potential comps are identified separately by the team and the player’s agency based on a few variables that have become standardized over time, such as signing status (RFA/UFA), position, age, size (this deserves its own article…), and P/GP and GP in the player’s career and career-to-platform seasons. Other info and stats definitely come into play but almost always play a lesser role.

Both the team and the agency will likely lean towards comps that are more favorable for their case, but once those tactics are canceled out in negotiation, more often than not the team and agency arrive in the same ballpark of comps, with multiple “common comps” identified.

Market value for trades is not as well defined as it is for signings (there is more room for “fleecing”), but it works the same way in that both parties (in this case two teams) identify comps (in this case, historical trades involving similar players) and then negotiate around them.

Where’s the Analytics?

While I personally find statistical models very helpful for determining market value for player transactions (Evolving-Hockey’s contract projections are very handy, for example), teams were using the method and standards I described above for decades before analytics departments became a thing, and they are used to doing it this way. In my experience, statistical models are used 1) as a quick resource in meetings to get a sense of value, and 2) as a second opinion to support or call into question the conclusions reached after researching comps.

There are other assets in the NHL that are much more difficult to evaluate without statistical methods. In this series, I’m going to write about two types of statistically derived market value charts: draft pick value, and cap relief value.

With the NHL trade deadline around the corner, a cap relief value chart (“how much is $1M in cap relief worth in draft picks?”) will come in handy to analyze third-team-retention trades. Teams themselves are using these kinds of charts to help determine the appropriate cost for retaining cap and salary come deadline time.

The draft is much further away, but my cap relief value chart uses my draft pick value chart, so we’re going to start by looking at draft pick value.

On the Floor

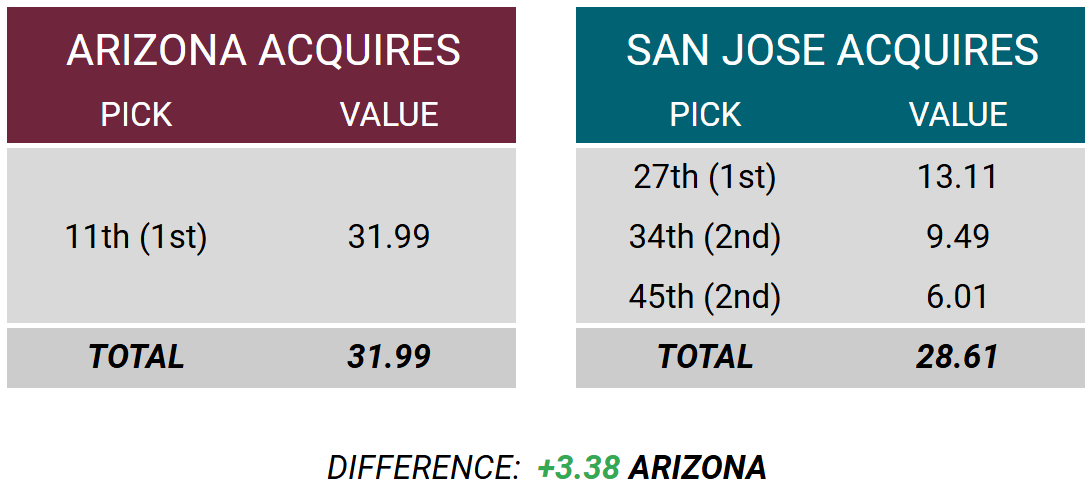

At the 2022 draft, the Arizona Coyotes traded picks 27, 34 and 45 to the San Jose Sharks in exchange for pick 11. How does this kind of thing happen?

Disclosure: I was with the Coyotes when this trade occurred but I won’t be disclosing any inside info here. I’m going to walk you through trades in general terms using only publicly available information.

Let’s say you are one of those teams and the other calls you on the draft floor to propose the trade. How do you come to a yes or no decision?

Both teams have prepared for this situation long before the call was placed. Their Hockey Ops departments have created a list that details the potential draft pick swaps they can make and want to make.

They work through what trades are possible:

Who owns each pick in this draft and the next three/four drafts? “Known” draft picks are preferred — the uncertainty of where picks in future drafts will lie makes their inclusion less desirable.

What is the market value of each pick? What have these picks been exchanged for in the past? This is an area where analytics departments had an early impact in helping their Hockey Ops determine value. In 2013, Eric Tulsky showed us how to take the set of historical NHL draft pick trades and fit an equation/curve to the data that makes the set of trades as fair as possible on the whole. Once you have an equation, you can plug the actual ownership of each pick in and solve to determine the set of trades that are most fair or close to fair.

Once they know what trades are possible, Hockey Ops determines what trades are desirable:

Is there money on the table? This is where the most time is spent and what will have the most impact on decision making. In addition to projecting where players should be taken in the draft, amateur scouting departments will supply their Hockey Ops with a projection of where they think players will be taken in the draft. It’s a poorly kept secret in the NHL that scouts talk, and the sharp ones are listening to what other teams’ scouts are saying. They combine this knowledge with respected media opinions to build a projected consensus. Based on this, Hockey Ops will identify players they like above the value of where they think they will go.

Is market value right on average? The analytics department’s performance value chart may also be considered. In these models, pick value is derived from the aggregate statistics of players taken at each pick. Early public models used GP and TOI, while more recent ones incorporate points and other stats. This kind of chart might be more likely to come into play if its pick values differ considerably from the market value chart in the ranges where the potential trade applies.

All of this information is considered and a decision is made. Most likely, when a team is deciding to propose a trade or accept a trade on the draft floor, the deciding factor is the amateur scouting department’s evaluation of the best player available. If they want him, they go get him.

With both teams prepared ahead of time, the decision is quick and easy to make on the floor. There may be a small negotiation (“throw in next year’s 7th rounder”), but if both teams did it right, the “proposer” of the deal is suggesting an idea that the “receiver” has on their prepared list.

The Glue

What makes everything work is that every team’s market value chart looks more or less the same. Here’s one I created for PuckPedia, inspired by Tulsky’s method and updated with all pick swap trades since then.

I recommend reading Tulsky’s 2013 article for the methodology, but if you want to skip it, the idea is to produce a value for every pick (1-224) based on a curve ‘fit’ to actual historical draft pick swaps.

It looks like this:

CHECK OUT the PUCKPEDIA PERRI PICK VALUE CALCULATOR!

All you need to know to use the chart is this: The first overall pick has a value of 100.00, and the second overall has a value of 72.69. To make a fair trade involving these picks, the team with the second overall would need to make up the difference of 27.31. The fourteenth overall pick, with a value of 26.46, is a good candidate.

Let’s plug in these values into the actual example I mentioned earlier in this article:

According to the chart, this was the 5th largest pick swap trade since 2005-06, and the biggest draft day pick swap in recent memory. Having worked for Arizona at the time, the green next to their name makes me happy.

See You Next Time

Thanks to PuckPedia for letting me use their data and making this possible.